API Documentation¶

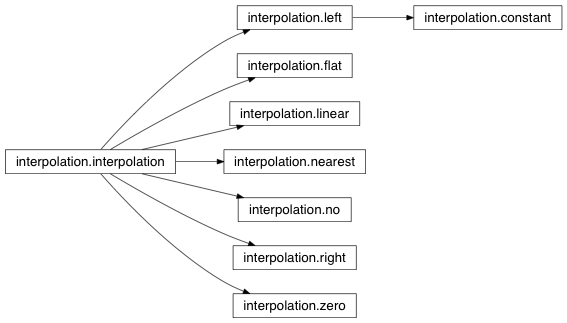

Interpolation¶

interpolation.interpolation |

|

interpolation.no |

|

interpolation.left |

|

interpolation.constant |

|

interpolation.flat |

|

interpolation.right |

|

interpolation.flat |

|

interpolation.nearest |

|

interpolation.zero |

-

class

interpolation.constant(x_list=[], y_list=[])[source]¶ Bases:

interpolation.left

-

class

interpolation.flat(y=0.0)[source]¶ Bases:

interpolation.interpolation

-

class

interpolation.left(x_list=[], y_list=[])[source]¶ Bases:

interpolation.interpolation

-

class

interpolation.linear(x_list=[], y_list=[])[source]¶ Bases:

interpolation.interpolation

-

class

interpolation.nearest(x_list=[], y_list=[])[source]¶ Bases:

interpolation.interpolation

-

class

interpolation.no(x_list=[], y_list=[])[source]¶ Bases:

interpolation.interpolation

-

class

interpolation.right(x_list=[], y_list=[])[source]¶ Bases:

interpolation.interpolation

-

class

interpolation.zero(x_list=[], y_list=[])[source]¶ Bases:

interpolation.interpolation

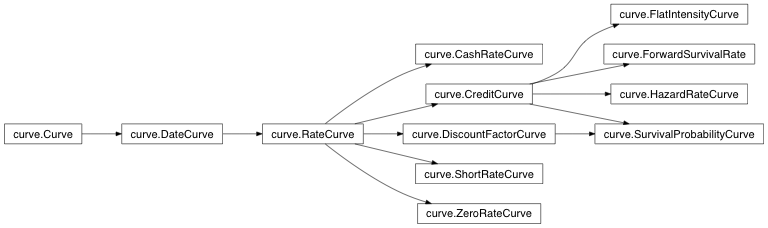

Curve¶

curve.Curve |

Curve object to build function |

curve.DateCurve |

|

curve.RateCurve |

|

curve.DiscountFactorCurve |

|

curve.ZeroRateCurve |

|

curve.CashRateCurve |

|

curve.ShortRateCurve |

|

curve.CreditCurve |

generic curve for default probabilities (under construction) |

curve.SurvivalProbabilityCurve |

|

curve.FlatIntensityCurve |

|

curve.ForwardSurvivalRate |

|

curve.HazardRateCurve |

-

class

curve.CashRateCurve(x_list, y_list, y_inter=None, origin=None, day_count=None, forward_tenor=None)[source]¶ Bases:

curve.RateCurve

-

class

curve.CreditCurve(x_list, y_list, y_inter=None, origin=None, day_count=None, forward_tenor=None)[source]¶ Bases:

curve.RateCurvegeneric curve for default probabilities (under construction)

-

class

curve.Curve(x_list=None, y_list=None, y_inter=None)[source]¶ Bases:

objectCurve object to build function

Parameters: - x_list (list(float)) – source values

- y_list (list(float)) – target values

- y_inter (list(interpolation.interpolation)) – interpolation function on x_list (optional) or triple of (left, mid, right) interpolation functions with left for x < x_list[0] (as default triple.right is used) right for x > x_list][-1] (as default interpolation.constant is used) mid else (as default interpolation.linear is used)

Curve object to build function \(f:R \rightarrow R, x \mapsto y\) from finite point vectors \(x\) and \(y\) using piecewise various interpolation functions.

-

domain¶

-

curve.DAY_COUNT(start, end)¶

-

class

curve.DateCurve(x_list, y_list, y_inter=None, origin=None, day_count=None)[source]¶ Bases:

curve.Curve-

domain¶

-

-

class

curve.DiscountFactorCurve(x_list, y_list, y_inter=None, origin=None, day_count=None, forward_tenor=None)[source]¶ Bases:

curve.RateCurve

-

class

curve.FlatIntensityCurve(x_list, y_list, y_inter=None, origin=None, day_count=None, forward_tenor=None)[source]¶ Bases:

curve.CreditCurve

-

class

curve.ForwardSurvivalRate(x_list, y_list, y_inter=None, origin=None, day_count=None, forward_tenor=None)[source]¶ Bases:

curve.CreditCurve

-

class

curve.HazardRateCurve(x_list, y_list, y_inter=None, origin=None, day_count=None, forward_tenor=None)[source]¶ Bases:

curve.CreditCurve

-

class

curve.RateCurve(x_list, y_list, y_inter=None, origin=None, day_count=None, forward_tenor=None)[source]¶ Bases:

curve.DateCurve

-

class

curve.ShortRateCurve(x_list, y_list, y_inter=None, origin=None, day_count=None, forward_tenor=None)[source]¶ Bases:

curve.RateCurve

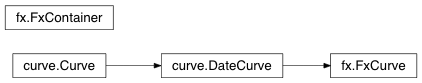

Fx Objects¶

fx.FxCurve |

fx rate curve for currency pair |

fx.FxContainer |

FxDict factory object |

-

class

fx.FxContainer(currency, domestic_curve)[source]¶ Bases:

dictFxDict factory object

using triangulation over self.currency defined as a global container of fx information (mainly vs base currency)

today = businessdate() curve = ZeroRateCurve([today], [.02]) container = FxContainer('USD', curve) foreign = ZeroRateCurve([today], [.01]) container.add('EUR', foreign, 1.2) fx_curve = container['USD', 'EUR'] # fx_curve is FxCurve fx_dict = container['USD'] # fx_dict is dict of FxCurves containing fx_curve container['USD']['EUR'](today) == container['USD', 'EUR'](today) # True

Parameters: - currency – base currency of FxContainer

- domestic_curve (RateCurve) – base curve of FxContainer for discounting

-

class

fx.FxCurve(x_list, y_list=None, y_inter=None, origin=None, day_count=None, domestic_curve=None, foreign_curve=None)[source]¶ Bases:

curve.DateCurvefx rate curve for currency pair

Compounding¶

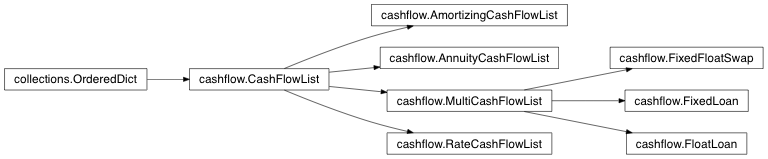

Cashflow¶

cashflow.CashFlowList |

|

cashflow.AmortizingCashFlowList |

|

cashflow.AnnuityCashFlowList |

|

cashflow.RateCashFlowList |

|

cashflow.MultiCashFlowList |

|

cashflow.FixedLoan |

|

cashflow.FloatLoan |

|

cashflow.FixedFloatSwap |

ir swap that pays fixed and receives float. |

-

class

cashflow.AmortizingCashFlowList(pay_date_list, amount_list=None)[source]¶ Bases:

cashflow.CashFlowList

-

class

cashflow.AnnuityCashFlowList(pay_date_list, amount_list=None)[source]¶ Bases:

cashflow.CashFlowList

-

class

cashflow.CashFlowList(pay_date_list, amount_list=None)[source]¶ Bases:

collections.OrderedDict

-

class

cashflow.FixedFloatSwap(date_list, fixed_rate, forward_curve, notional_list=None, day_count=None)[source]¶ Bases:

cashflow.MultiCashFlowListir swap that pays fixed and receives float.

-

class

cashflow.FixedLoan(legs)[source]¶ Bases:

cashflow.MultiCashFlowList

-

class

cashflow.FloatLoan(legs)[source]¶ Bases:

cashflow.MultiCashFlowList

-

class

cashflow.MultiCashFlowList(legs)[source]¶ Bases:

cashflow.CashFlowList

-

class

cashflow.RateCashFlowList(date_list, day_count, fixed_rate=0.0, forward_curve=None, notional_list=None)[source]¶ Bases:

cashflow.CashFlowList