API Documentation¶

Risk Factor Modeling¶

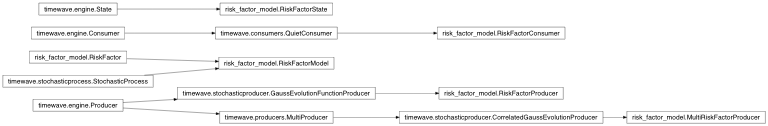

risk_factor_model.RiskFactor |

|||||

risk_factor_model.RiskFactorModel |

|

||||

risk_factor_model.RiskFactorState |

|

||||

risk_factor_model.RiskFactorProducer |

|

||||

risk_factor_model.MultiRiskFactorProducer |

|

||||

risk_factor_model.RiskFactorConsumer |

consumer of RiskFactorState | ||||

-

class

risk_factor_model.MultiRiskFactorProducer(process_list, correlation=None, diffusion_driver=None)[source]¶ Bases:

timewave.stochasticproducer.CorrelatedGaussEvolutionProducerParameters: - process_list (list(RiskFactorModel)) –

- correlation (list(list(float)) or dict((RiskFactorModel, RiskFactorModel): float)) – correlation of diffusion drivers of risk factors

- diffusion_driver (list(RiskFactorModel)) – index of diffusion driver if correlation is given by simple matrix (list(list(float)))

initialize MultiRiskFactorProducer

-

class

risk_factor_model.RiskFactor[source]¶ Bases:

object-

inner_factor¶ RiskFactor typically move given data structure like yield curves, fx curves or volatility surfaces. The inner factor is the driven structure.

-

-

class

risk_factor_model.RiskFactorConsumer(*risk_factor_list)[source]¶ Bases:

timewave.consumers.QuietConsumerconsumer of RiskFactorState

Parameters: risk_factor_list (list(RiskFactor)) – list of risk factors which will be driven by risk factor state initialize RiskFactorConsumer

-

consume(state)[source]¶ Parameters: state (RiskFactorState) – specific process state Return object: the new consumer state returns pair the first element is the list of updated simulated hw curves the second element is True (indicates Curve mapping)

-

initialize(grid=None, num_of_paths=None, seed=None)[source]¶ Parameters: - grid (list(BusinessDate)) – list of Monte Carlo grid dates

- num_of_paths (int) – number of simulation path

- seed (hashable) – initial seed of random generators

sets pre calculation depending only on grid

-

start_date= None¶ BusinessDate – valuation date

-

-

class

risk_factor_model.RiskFactorModel(inner_factor, start_value=0.0)[source]¶ Bases:

timewave.stochasticprocess.StochasticProcess,risk_factor_model.RiskFactorParameters: - inner_factor (Curve or Volatility or object) – parameter object which is modeled by the risk factor model

- start_value (float or tuple) –

initialize risk factor model

-

evolve(x, s, e, q)[source]¶ Parameters: - x (float) – current state value, i.e. value before evolution step

- s (BusinessDate) – current point in time, i.e. start point of next evolution step

- e (BusinessDate) – next point in time, i.e. end point of evolution step

- q (float) – standard normal random number to do step

Return float: next state value, i.e. value after evolution step

evolves process state x from s to e in time depending of standard normal random variable q

-

evolve_risk_factor(x, s, e, q)[source]¶ Parameters: - x (float) – current state value, i.e. value before evolution step

- s (BusinessDate) – current point in time, i.e. start point of next evolution step

- e (BusinessDate) – next point in time, i.e. end point of evolution step

- q (float) – standard normal random number to do step

Return float: next state value, i.e. value after evolution step

evolves process state x from s to e in time depending of standard normal random variable q and sets risk factor at e to x after evolving from s.

-

get_numeraire(value_date)[source]¶ Parameters: value_date (BusinessDate) – date of Return float: returns the numeraire value

-

pre_calculate(s, e)[source]¶ Parameters: - s (BusinessDate) – start date pre calc step

- e (BusinessDate) – end date pre calc step

pre calculation depending only on dates and model data (RiskFactor method)

-

set_risk_factor(factor_date, factor_value=None)[source]¶ Parameters: - factor_date (BusinessDate) – sets risk factor state at this date

- factor_value (float or tuple) – sets risk factor state to this value

sets risk factor state, method should be idempotent, i.e. setting same state twice must not change risk factor state at all (RiskFactor method)

-

class

risk_factor_model.RiskFactorProducer(process)[source]¶ Bases:

timewave.stochasticproducer.GaussEvolutionFunctionProducerParameters: process (RiskFactorModel) – producer for timewave simulation framework to evolve a RiskFactorModel depending of standard normal random values

Market Risk Factors¶

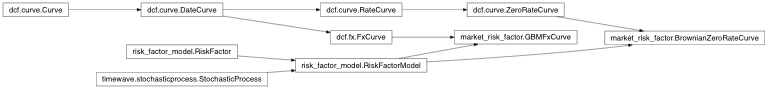

market_risk_factor.BrownianZeroRateCurve |

simple Brownian motion rate diffusion |

market_risk_factor.GBMFxCurve |

models fx spot rate as spot * x |

-

class

market_risk_factor.BrownianZeroRateCurve(x_list=None, y_list=None, y_inter=None, origin=None, day_count=None, forward_tenor=None, drift=0.0, volatility=0.0, inner_factor=None)[source]¶ Bases:

dcf.curve.ZeroRateCurve,risk_factor_model.RiskFactorModelsimple Brownian motion rate diffusion

initializes Hull White curve

Parameters: - x_list (list(float)) –

- y_list (list(float)) –

- y_inter (list(interpolation)) –

- origin (BusinessDate) –

- day_count (DayCount) –

- forward_tenor (BusinessPeriod) –

- or function drift (float) –

- or function volatility (float) –

- inner_factor (RateCurve) –

-

class

market_risk_factor.GBMFxCurve(x_list=None, y_list=None, y_inter=None, origin=None, day_count=None, domestic_curve=None, foreign_curve=None, volatility=0.0, inner_factor=None)[source]¶ Bases:

dcf.fx.FxCurve,risk_factor_model.RiskFactorModelmodels fx spot rate as spot * x

Parameters: - x_list (list(BusinessDate)) –

- y_list (list(BusinessDate)) –

- y_inter (list()) –

- origin (BusinessDate) –

- day_count (DayCount) –

- domestic_curve (RateCurve) –

- foreign_curve (RateCurve) –

- or function volatility (float) –

- inner_factor (FxCurve) –

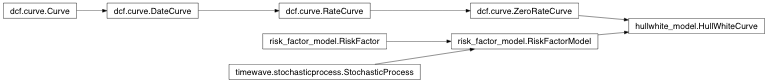

The Hull White Model¶

hullwhite_model.HullWhiteCurve |

calculation of discount factors in the Hull White model |

-

class

hullwhite_model.HullWhiteCurve(x_list=None, y_list=None, y_inter=None, origin=None, day_count=None, forward_tenor=None, mean_reversion=0.0, volatility=0.0, terminal_date=None, inner_factor=None)[source]¶ Bases:

dcf.curve.ZeroRateCurve,risk_factor_model.RiskFactorModelcalculation of discount factors in the Hull White model

Parameters: - x_list (list(float)) –

- y_list (list(float)) –

- y_inter (list(interpolation)) –

- origin (BusinessDate) –

- day_count (DayCount) –

- forward_tenor (BusinessPeriod) – standard forward

- mean_reversion (float or function) – mean reversion speed of short rate process

- volatility (float or function) – short rate volatility

- terminal_date (BusinessDate) – date of terminal measure

- inner_factor (RateCurve) –

initializes Hull White curve

-

calc_integral_B(t1, t2)[source]¶ returns the value of the helper function B

\[B(t_1, t_2) = \int_{t_1}^{t_2} I_1(t_1, \tau) \, \mathrm{d}\tau = \frac{1}{a}\Big(1 - \mathrm{e}^{-a(t_2 - t_1)}\Big)\]Parameters: - t1 (float) – start time as year fraction / float

- t2 (float) – end time as year fraction / float

Return float:

-

calc_integral_I1(t1, t2)[source]¶ Parameters: - t1 (float) – start time as year fraction / float

- t2 (float) – end time as year fraction / float

Returns: float

returns the value of the helper function I1

\[I_1(t_1, t_2) = \exp \left( -\int_{t_1}^{t_2} a(\tau) \,\mathrm{d}\tau \right) = \mathrm{e}^{-a(t_2 - t_1)}\]

-

calc_integral_I1_squared(t1, t2)[source]¶ Parameters: - t1 (float) – start time as year fraction / float

- t2 (float) – end time as year fraction / float

Return float: returns the value of the helper function I1^2

\[I_1(t_1, t_2)^2 = \exp \left( -2\int_{t_1}^{t_2} a(\tau) \,\mathrm{d}\tau \right) = \mathrm{e}^{-2a(t_2 - t_1)}\]

-

calc_integral_I2(s, t)[source]¶ Parameters: - s (float) – start time as year fraction / float

- t (float) – end time as year fraction / float

Return float: returns the value of the helper function Integrals

One of the deterministic terms of a step in the MC simulation is calculated here with last observation date for T-Bond numeraire T

\[\int_s^t \sigma^2(u) I_1(u,t) (B(u,t)-B(u,T)) \,\mathrm{d} u + B(s,t)I_1(s,t)\int_0^s \sigma^2(u) I_1^2(u,s)\,\mathrm{d}u\]

-

calc_integral_volatility_squared_with_I1(t1, t2)[source]¶ Parameters: - t1 –

- t2 –

Return float: Calculates integral of integrand \(f\) with \(I_1\) between two time points \(t_1\) and \(t_2\) with \(t_1 \le t_2\) is as:

\[extrm{Var}_r(t_1,t_2) = \int_{t_1}^{t_2} vol(u)^2 I_1(u,t_2) \,\mathrm{d} u\]

-

calc_integral_volatility_squared_with_I1_squared(t1, t2)[source]¶ Parameters: - t1 –

- t2 –

Return float: calculates drift integral \(I_2\)

-

classmethod

cast(other, mean_reversion=0.0, volatility=0.0, terminal_date=None)[source]¶ Parameters: - other (ZeroRateCurve) –

- mean_reversion (float or function) – mean reversion speed of short rate process

- volatility (float or function) – short rate volatility

- terminal_date (BusinessDate) – date of terminal measure

Returns: HullWhiteCurve

build HullWhiteCurve i.e. Hull White model in terminal measure from ZeroRateCurve, mean reversion speed, volatility and terminal measure date.

-

evolve(x, s, e, q)[source]¶ Parameters: - x –

- s –

- e –

- q –

Returns: evolve Hull White process of shortrate diviation math:: y = r - y

-

get_discount_factor(start_date, end_date)[source]¶ Parameters: - start_date (BusinessDate) – start date

- end_date (BusinessDate) – end date

Return float: calculate the discount rate for the given start date and end date

\[P_{u,y}: \textrm{BusinessDate} {\times} \textrm{BusinessDate} \to \mathbb{R}\]and

\[(s,t) \mapsto P_{\text{init}}(s,t) \exp \left(-\frac{1}{2}(B^2(u,t)-B^2(u,s)) \int_0^u \sigma^2(\tau)I_1(\tau,t), \mathrm{d}\tau\right)\mathrm{e}^{-(B(t,T)-B(t,S))y}\]with \(P_{\text{init}}(s,t) = \verb|Curve.get_discount_curve(s,t)|\)

Here the variables with subscript \(\textrm{pld}\) are dates (BusinessDate instances) and the variables without subscripts are year fractions between the correspondent \(\textrm{pld}\) variables and \(\verb|validity_date|\) in the default DCC (Act/365.25).

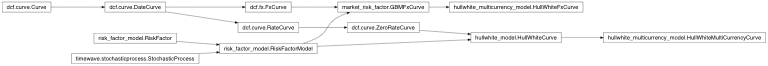

Multi Currency Hull White Model Extension¶

hullwhite_multicurrency_model.HullWhiteFxCurve |

|

||||

hullwhite_multicurrency_model.HullWhiteMultiCurrencyCurve |

initializes foreign Hull White curve in multi currency model | ||||

-

class

hullwhite_multicurrency_model.HullWhiteFxCurve(x_list=None, y_list=None, y_inter=None, origin=None, day_count=None, domestic_curve=None, foreign_curve=None, volatility=0.0, domestic_correlation=0.0, foreign_correlation=0.0, rate_correlation=0.0, inner_factor=None)[source]¶ Bases:

market_risk_factor.GBMFxCurveParameters: - x_list (list(BusinessDate)) –

- y_list (list(BusinessDate)) –

- y_inter (list()) –

- origin (BusinessDate) –

- day_count (DayCount) –

- domestic_curve (HullWhiteCurve) –

- foreign_curve (HullWhiteCurve) –

- volatility (float or function or Curve) –

- domestic_correlation (float) –

- foreign_correlation (float) –

- rate_correlation (float) –

- inner_factor (GBMFxCurve or FxCurve) –

-

classmethod

cast(fx_curve, domestic_curve, foreign_curve, volatility=0.0, correlation=None)[source]¶ Parameters: - fx_curve (GBMFxCurve or FxCurve) – FxCurve to retrieve factor expectation

- domestic_curve (HullWhiteCurve) – domestic HullWhiteCurve

- foreign_curve (HullWhiteCurve) – foreign HullWhiteCurve

- volatility (float or function) – fx spot forward volatility

- correlation (dict(RiskFactorModel, RiskFactorModel)) – correlation matrix indexed by risk factors

Build HullWhiteFxCurve from HullWhiteCurves and GBMFxCurve. Terminal measure date in foreign_curve is ignored since it is taken from domestic_curve.

-

evolve(x, s, e, q)[source]¶ Parameters: - x (float) – current state value, i.e. value before evolution step

- s (BusinessDate) – current point in time, i.e. start point of next evolution step

- e (BusinessDate) – next point in time, i.e. end point of evolution step

- q (float) – standard normal random number to do step

Return float: next state value, i.e. value after evolution step

evolves process state x from s to e in time depending of standard normal random variable q

-

class

hullwhite_multicurrency_model.HullWhiteMultiCurrencyCurve(x_list=None, y_list=None, y_inter=None, origin=None, day_count=None, forward_tenor=None, mean_reversion=0.0001, volatility=0.0, domestic_curve=None, fx_curve=None, foreign_correlation=0.0, rate_correlation=0.0, inner_factor=None)[source]¶ Bases:

hullwhite_model.HullWhiteCurveinitializes foreign Hull White curve in multi currency modelParameters: - x_list (list(float)) –

- y_list (list(float)) –

- y_inter (list(interpolation)) –

- origin (BusinessDate) –

- day_count (DayCount) –

- forward_tenor (BusinessPeriod) –

- or function mean_reversion (float) – volatility of foreign short rate process

- or function volatility (float) – volatility of foreign short rate process

- domestic_curve (HullWhiteCurve) – domestic rate HullWhite process

- or GBMFxCurve fx_curve (HullWhiteFxCurve) – fx curve with volatility of ln(fx) process

- foreign_correlation (float) – correlation of ln(fx) process and foreign rate process

- rate_correlation (float) – correlation of domestic rate process and foreign rate process

- inner_factor (RateCurve) –

-

calc_integral_I2(s, t)[source]¶ calculates the following integral (see formula for the step in the MC evolution)

\[\begin{split}\textrm{Var}(\chi(t) | \mathcal{F}_s) = \int_s^t \sigma^2_d(u)B^2_d(u, T) + \sigma^2_f(u)B^2_f(u,T) + \sigma^2_{FX}(u) \\ + 2\left(- \rho_{d,f} B_f(u, T)\sigma_f(u)B_d(u, T)\sigma_d(u) + \left( - \rho_{f,FX} B_f(u, T)\sigma_f(u) + \rho_{d,FX} B_d(u, T)\sigma_d(u) \right) \sigma_{FX}(u) \right)\,\mathrm{d}u\end{split}\]Parameters: - s (float) –

- t (float) –

Return float:

-

classmethod

cast(foreign_curve, domestic_curve, fx_curve)[source]¶ Parameters: - foreign_curve (HullWhiteCurve) –

- domestic_curve (HullWhiteCurve) –

- fx_curve (HullWhiteFxCurve) –

Return HullWhiteMultiCurrencyCurve: build HullWhiteMultiCurrencyCurve from HullWhiteCurves and HullWhiteFxCurve. Terminal measure date in foreign_curve is ignored since it is taken from domestic_curve.